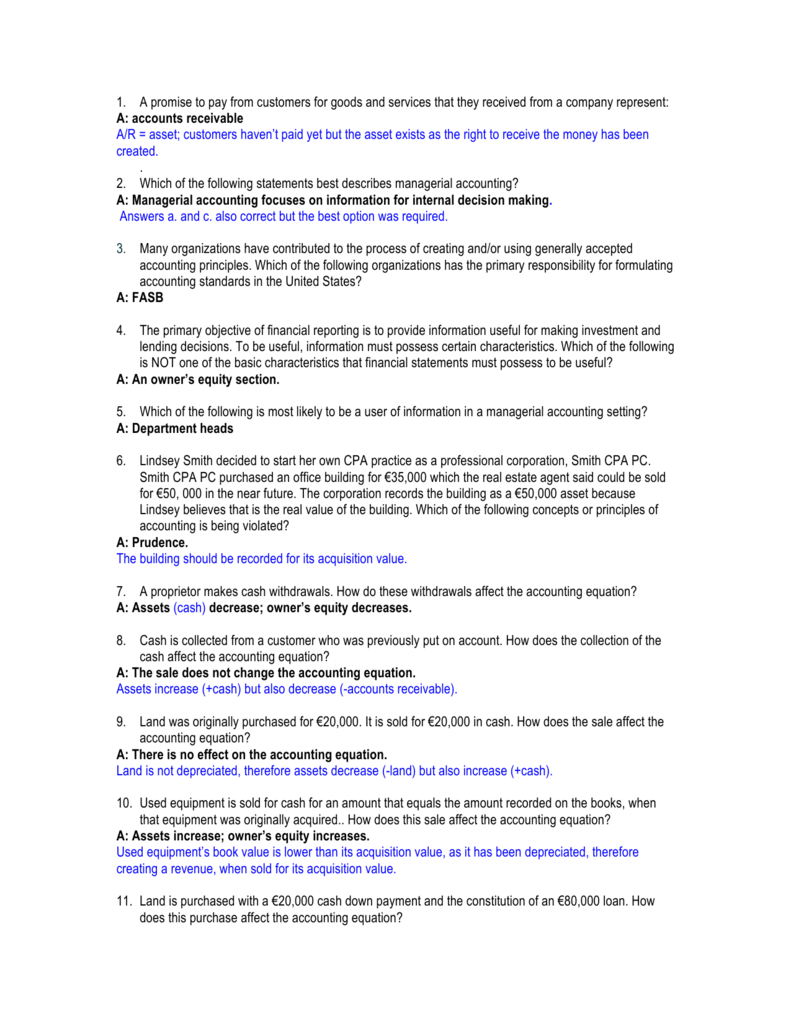

Bills Receivable In Accounting Equation : Accounting Blog What Is Accounts Payable And Receivable : An income statement is prepared to reflect the company's total expenses and total income.

Bills Receivable In Accounting Equation : Accounting Blog What Is Accounts Payable And Receivable : An income statement is prepared to reflect the company's total expenses and total income.. In essence, the accounting equation is: Hence, this forms the basis of a lot of analysis to market investors, financial analysts, research analysts, and other financial institutions. The accounting equation shows the relationship between these items. (i) commenced business with cash ₹ 50,000, cheque ₹ 1,00,000, goods ₹ 30,000 and furniture ₹ 20,000. In this form, it is easier to highlight the relationship between shareholder's equity and debt (liabilities).

(vii) received ₹ 10,000 from gupta against the bills receivable on its maturity. Accounts receivable are considered an asset and are reflected on your balance sheet as such. The solution for this question is as follows: You can rearrange the equation to suit your preferences better. Liabilities and owner's equity are unaffected.

The above accounting equation signifies that assets of a business are always equal to the total of outside liabilities and proprietor's equity.

An income statement is prepared to reflect the company's total expenses and total income. The usage and the amount of each bill is generally based on the meters located on the comp. Effect of collecting accounts receivable on the accounting equation and financial statements. An account receivable is documented through an invoice, which the seller is responsible for issuing to the customer through a billing procedure. The above accounting equation signifies that assets of a business are always equal to the total of outside liabilities and proprietor's equity. Accounting is a way of getting information about the transactions and events within the business in reports that are used by persons interested in the entity. The two types of accounts are very similar in the way they are recorded, but it is important to differentiate between accounts payable vs accounts receivable because one of them is an asset account and the other is a liability account. Dividends of $60 each are paid to the corporation's stockholders. Possesses assets of $10,000 and the source of those assets was the owner, mr. The invoice describes the goods or services that have been sold to the customer, the amount it owes the seller (including sales taxes and freight charges), and when it is supposed to pay. Q.17 prepare accounting equation from the following: Accounts receivable turnover is calculated by dividing net credit sales by the average accounts receivable for that period. Not only does the balance sheet reflect the basic accounting equation as implemented, but also the income statement.

On the other hand, bills receivables are drawn when a vendor or seller makes any credit sale to the business. Liabilities and owner's equity are unaffected. Q.17 prepare accounting equation from the following: The reason net credit sales are used instead of net sales is that cash sales don't create receivables. These bills appear on the asset side of the balance sheet.

Assets = liabilities + shareholders' equity the assets in the accounting equation are the resources that a company has available for its use, such as cash, accounts receivable, fixed assets, and inventory.

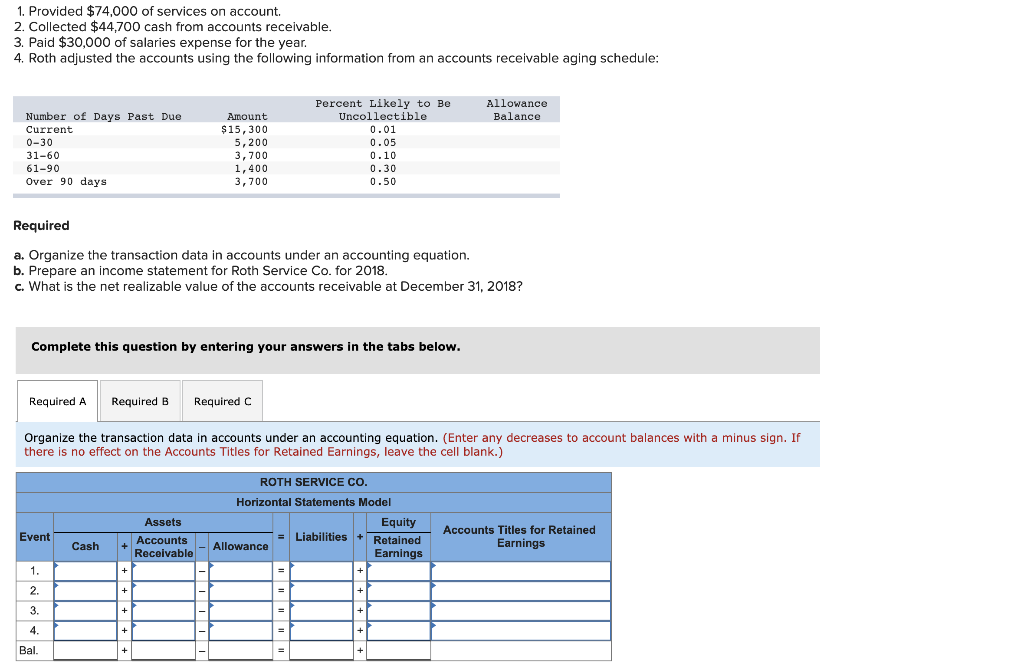

The reason net credit sales are used instead of net sales is that cash sales don't create receivables. In accounting, confusion sometimes arises when working between accounts payable vs accounts receivable. Based on this information alone, determine the following for burke company. Only credit sales establish a receivable, so the cash sales are left out of the calculation. Accounts receivable are considered an asset and are reflected on your balance sheet as such. Cash (accounts receivable) after a sale of goods or services. Burke company earned $12,000 of service revenue on account during 2014. Show the accounting equation on the basis of the following transactions & also show the balance sheet. The company collected $9,800 cash from accounts receivable during 2014. Assets = liabilities + shareholders' equity the assets in the accounting equation are the resources that a company has available for its use, such as cash, accounts receivable, fixed assets, and inventory. Record this transaction in the accounting equation for russell's consulting service by: Hence, this forms the basis of a lot of analysis to market investors, financial analysts, research analysts, and other financial institutions. Bills receivable is often used as an alternative term for accounts receivable but more specifically relates to amounts due to a business under bills of exchange.

Effect of collecting accounts receivable on the accounting equation and financial statements. Show an accounting equation on the basis of the following transactions: Cash (accounts receivable) after a sale of goods or services. When a business sells goods to a customer they might also draw up a bill of exchange on the customer. Burke company earned $12,000 of service revenue on account during 2014.

The formula for calculating average accounts receivable is fairly basic, too.

Draw an accounting equation on the basis of the following transactions: The formula for calculating average accounts receivable is fairly basic, too. (there are no revenues on this date. Renewal and retiring of the bill; Possesses assets of $10,000 and the source of those assets was the owner, mr. Such bill is termed as bills receivable. The 3 customers, a, b and c are our debtors or accounts receivable. (i) commenced business with cash ₹ 50,000, cheque ₹ 1,00,000, goods ₹ 30,000 and furniture ₹ 20,000. In the above case the seller has bills receivable for the amount due from the buyer. The company's asset (cash) increases and another asset (accounts receivable) decreases. Bills receivable bills receivable represent amounts receivable under bills of exchange. The two types of accounts are very similar in the way they are recorded, but it is important to differentiate between accounts payable vs accounts receivable because one of them is an asset account and the other is a liability account. On the other hand, bills receivables are drawn when a vendor or seller makes any credit sale to the business.

Komentar

Posting Komentar